what is a closed tax lot report

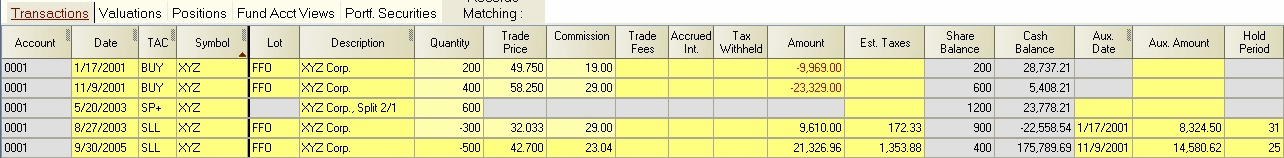

Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot. In the menu located next to the account select Tax Information.

In our example above we sold 20 shares of Company XYZ for 10.

. Go to the clients accounts page. By comparing the sale price to the cost basis you and the IRS make an accurate. Web On the Tax Information page select the button next to View Closed Tax Lots then select View Tax Information.

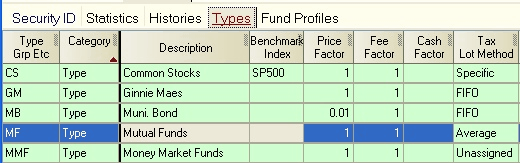

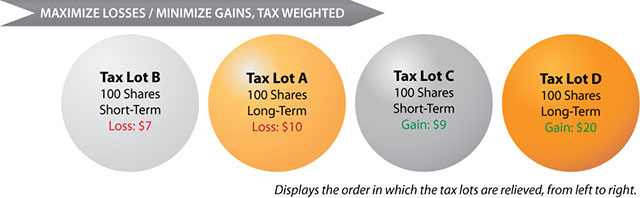

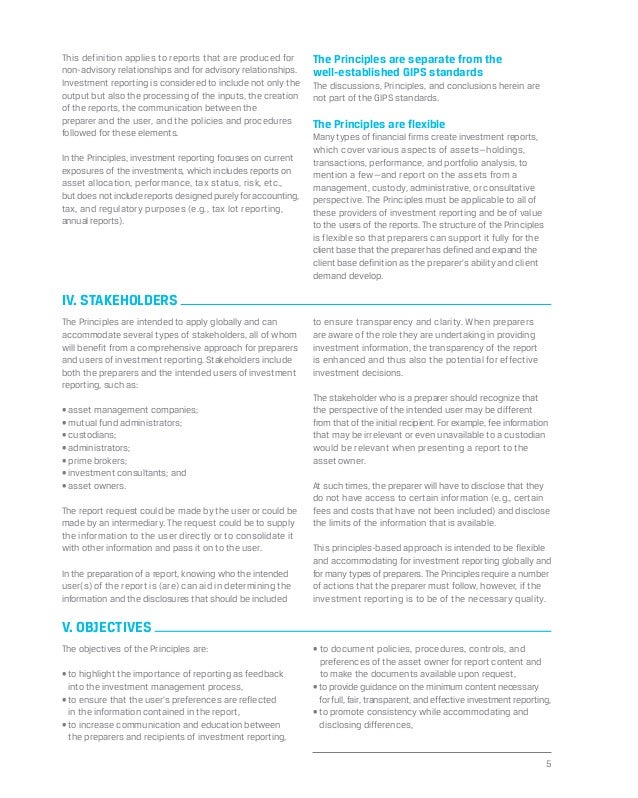

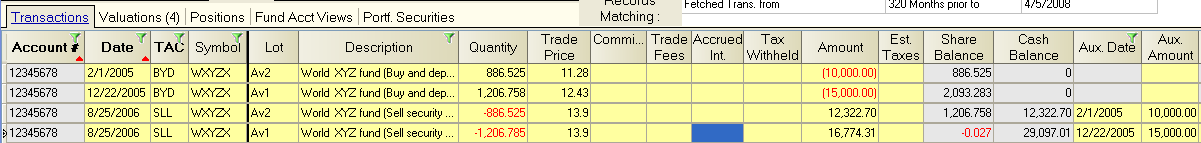

Web A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing. Tax lot accounting is the record of tax lots. Choose the time period and either Realized.

With closed tax lots you can track. Web What is a closed tax lot Report. Web Lot Relief Method.

Web To edit your clients tax lot. If available gainloss information is provided for closed lots that. Web Gain or loss amount.

Web If you cannot pay in full pay as much as you can to limit penalties and interest. Choose the time period and either Realized or Unrealized gain and loss information then select View Gains. What is the benefit of relieving tax lots at the account level.

Web Tax lot accounting is important because it helps investors minimize their capital gains taxes. Web To edit your tax lot. Every time you sell shares a closed tax lot is created to track the date and price of your sale.

There are five major lot relief methods that can be used for. Choose the time period and either Realized or Unrealized gain. You may want to exclude money market funds because they have no gains.

In the Actions menu located next to the account select Tax Information. If you have any questions about your account please call the IRS at 1-800-829. Web Set up an Investing Portfolio view that includes the securities and columns you are interested in.

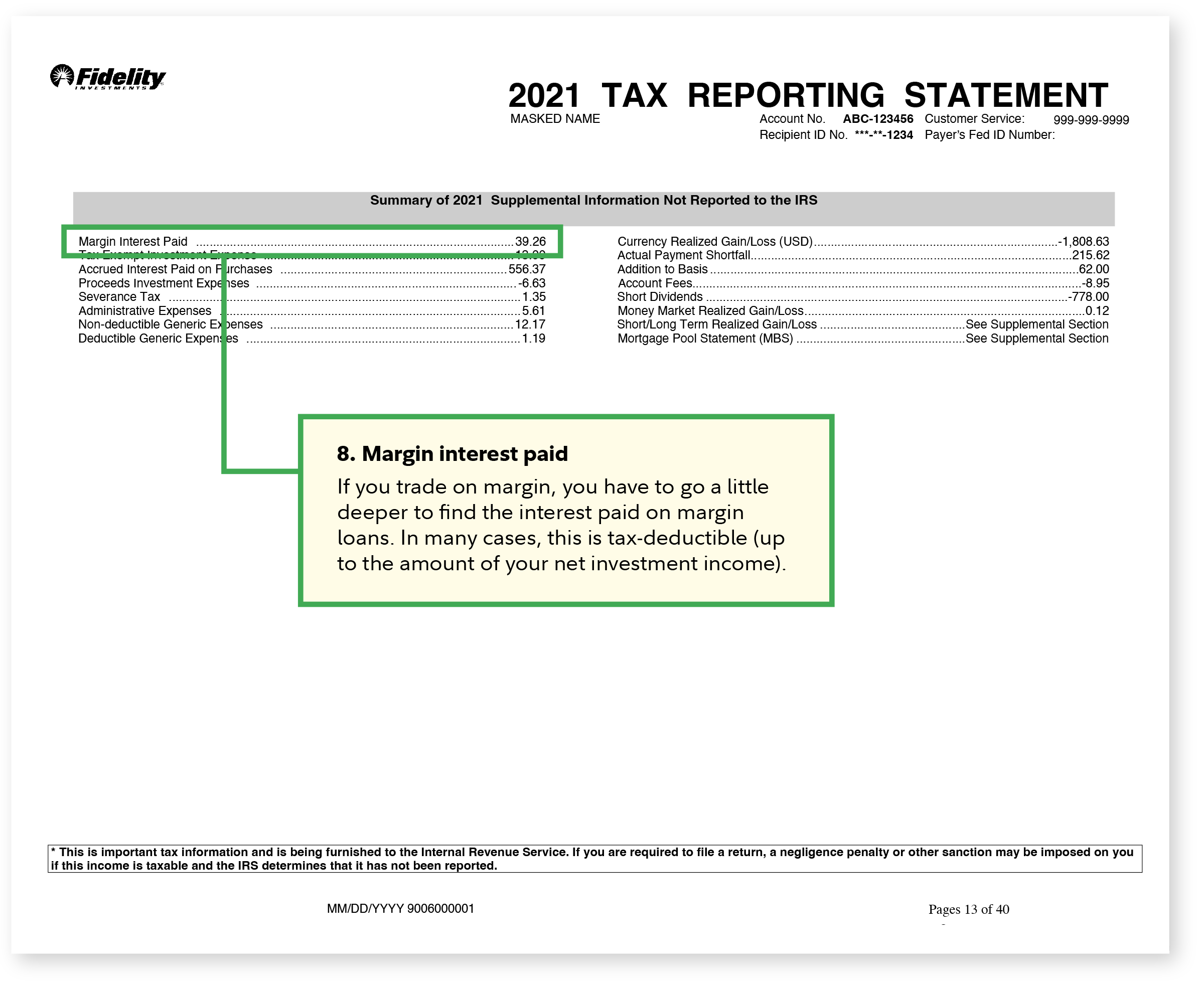

Web The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Web Our Tax Reporting web pages include a wealth of important tax-related information including. Go to your Accounts page.

Web What is a closed tax lot Report. Web Finally the tax lot includes the sale price of the securities in the lot. A method of computing the cost basis of an asset that is sold in a taxable transaction.

A list of all tax forms and reports for the current tax year with links to the actual.

How Are Options Taxed Charles Schwab

Cryptocurrency Tax Guide How To File In 2022 Nextadvisor With Time

Understanding Crypto Taxes Coinbase

Tax Lots Manage Your Account Frequently Asked Questions Help Center

The Sales Tax That Pays For Miller Park Could End In About Two Years

How To Download Capital Gains Statement And Upload It On Cleartax Platform For Itr Filing

Tax Commission Expense 2015 Form Fill Out Sign Online Dochub

Cfa Principles For Investment Reporting

Solving Crypto Taxes In India With Cointracker Blog By Quicko

Depot Lot Separation Support Desk

:max_bytes(150000):strip_icc()/quarter_final-d753501b38024da6b075a2fc2425725b.png)